Stockwatch: BP and Shell - can oil price rebound last?

Energy prices remain volatile and any number of geopolitical events could affect sentiment. Ahead of Trump’s inauguration, analyst Edmond Jackson gives his rating for both these UK oil majors.

14th January 2025 12:11

by Edmond Jackson from interactive investor

A defining feature of early 2025 is sharp rallies in BP (LSE:BP.) and Shell (LSE:SHEL) – up around 10% and 8% respectively – while early buyers were able to lock in a likely 2025 yield above 6.5% for BP and 5% for Shell. By comparison, bellwether US oil major Exxon Mobil Corp (NYSE:XOM) is up just 1.5% and offering a 4% yield.

As befits US vs UK shares, Exxon’s rating is at a relative price/earnings (PE) premium: a multiple around 13x vs 8x for BP and Shell, assuming 2025 consensus expectations. Yet the greater share price moves of the London-listed pair suggests factors at play other than a sudden unexpected rally in energy prices. Crude oil has jumped due to US sanctions on Russian oil – a departing salvo from the Biden administration – on top of a cold snap in America and Europe driving demand for gas and heating oil.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Oil prices are suddenly at a six-month high. Yesterday, Brent crude rose more than 2% to over $81 a barrel, its highest level since last August, although it slipped 0.5% early today.

Foreign exchange looks a factor also, an example how Britain’s fiscal chaos can have a silver lining for investors. Sterling share prices have been negatively affected yet the underlying commodity is priced in dollars and rising, hence an inflection point on charts at least, begging the question about whether this flows through to company operations. In the first fortnight of 2025, BP and Shell – as liquid FTSE 100 shares – have partly offered a domestic bolthole on currency risks as sterling has plunged.

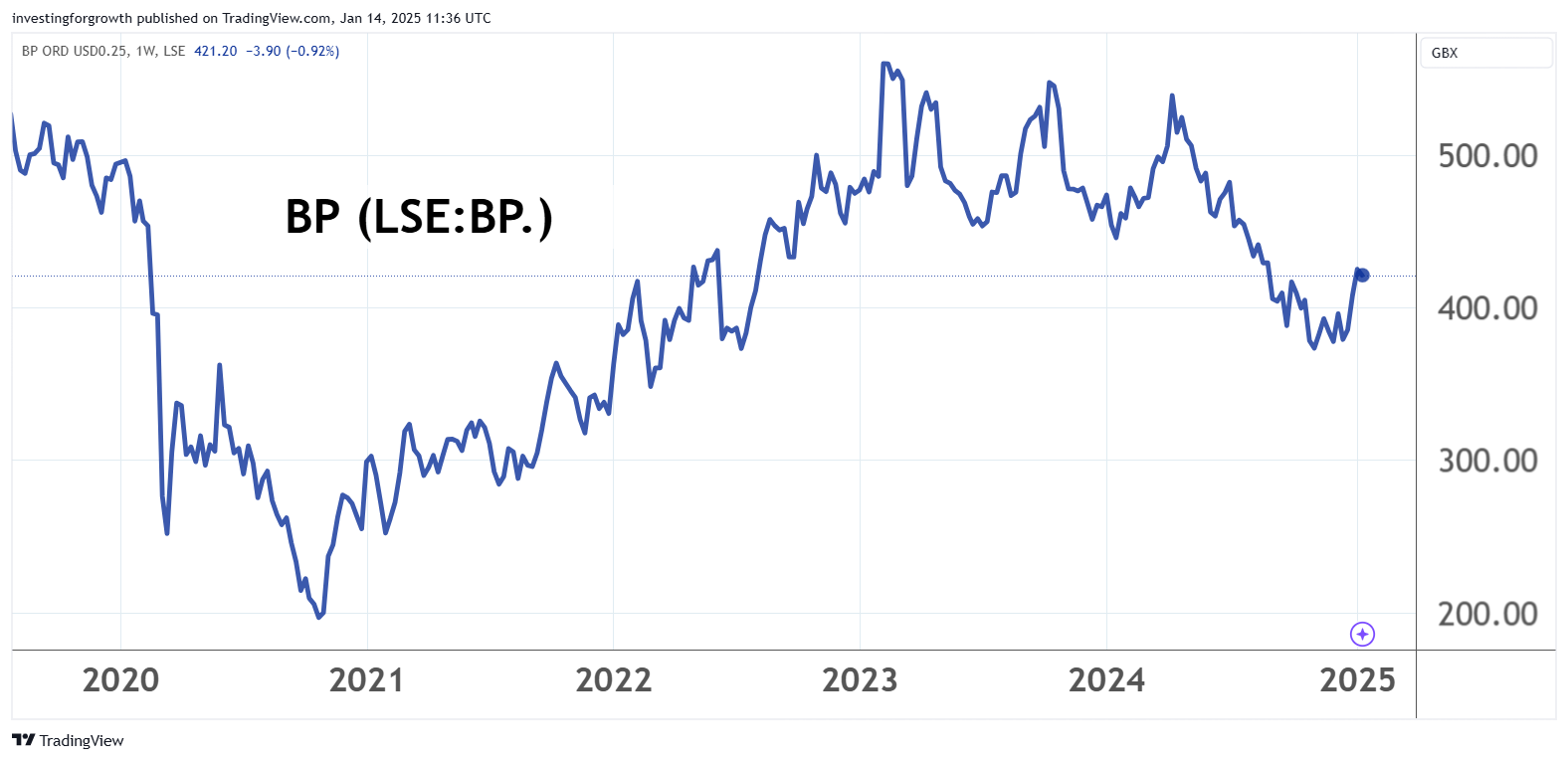

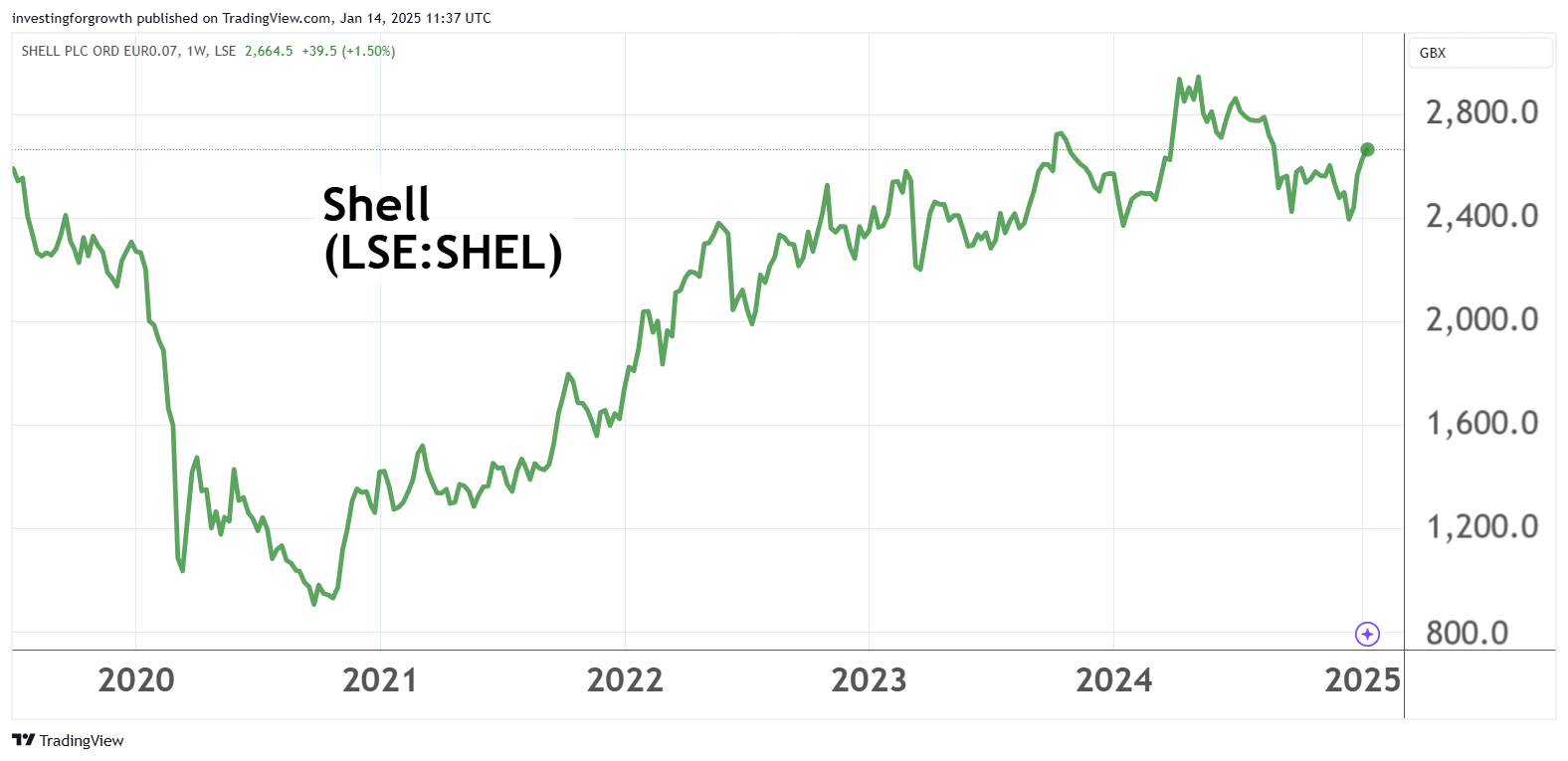

But is this a genuine turning point, or just another phase in oil-sector volatility, able to defy even expert predictions? BP and Shell alike recovered consistently from the 2020 Covid sell-off until spring 2024 as concerns about global growth (demand vs excess supply) began to gnaw at confidence.

Source: TradingView. Past performance is not a guide to future performance.

Oil price dynamics may continue to defy expectations

Key concerns have been the effect of President-elect Donald Trump’s promised tariffs on economic activity and his “drill, baby, drill” policy towards cheaper energy that is aimed to put economic pressure on Russia to end the war in Ukraine.

Perhaps these stories owe more to Christmas spirits-infused imagination than cold new-year reality, considering the extent of power a US president truly has.

On tariffs: beyond key goods for national security, a bristling US legal system is likely to oblige companies to make all manner of filings against tariffs, which even if not immediately successful could gum up Trump’s aims.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Shell still top pick after shares upgrade

As for “driving down the international price of oil”, that would likely require co-operation from Saudi Arabia, and it’s unclear if it could be convinced.

Rallies in BP and Shell therefore have a strong “top-down” element, with potentially more upside risks with Brent crude oil in a $70-75 range during November and December than consensus reckoned.

Oil and gas sector specialists at major investment banks and commodity trading houses tended to huddle around the $70 range continuing in 2025, given propensity for geopolitical factors to generate bull and bear drivers alike. But the year is young.

Q4 results have been operationally disappointing

Share price action around Shell announcing guidance for its fourth-quarter 2024 numbers on 8 January shows how macro factors remain dominant, even in the near term.

Its share price initially dipped in response to Shell citing lower gas production amid maintenance in Qatar; also significantly lower results in commodity trading as hedging contracts expire. Nowhere was the narrative especially positive with extraction (“upstream” production) down and $0.3 billion exploration write-offs. The loss in renewables is expected to widen.

Yet an initial 2% fall to 2,570p was absorbed by midday and Shell’s price continued to climb, closing yesterday at 2,660p.

Shell - financial summary

year end 31 Dec

reporting in US$

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover ($ million) | 233,591 | 305,179 | 388,379 | 344,877 | 180,543 | 261,504 | 381,314 | 316,620 |

| Operating margin (%) | 0.4 | 5.3 | 8.7 | 6.7 | -14.3 | 10.6 | 16.3 | 9.6 |

| Operating profit ($m) | 858 | 16,246 | 33,552 | 24,747 | -25,741 | 27,828 | 62,118 | 30,275 |

| Net profit ($m) | 4,575 | 12,977 | 23,352 | 15,843 | -21,680 | 20,101 | 42,309 | 19,359 |

| Reported EPS (cents) | 58.0 | 180 | 280 | 195 | -278 | 257 | 571 | 285 |

| Normalised EPS (cents) | 57.5 | 195 | 241 | 299 | 196 | 249 | 520 | 398 |

| Op. Cash flow/share (cents) | 261 | 430 | 636 | 520 | 437 | 578 | 923 | 797 |

| Capex/share (cents) | 280 | 251 | 276 | 283 | 213 | 243 | 305 | 338 |

| Free Cash flow/share (cents) | -19.0 | 178 | 360 | 237 | 225 | 334 | 618 | 459 |

| Dividend/share (cents) | 188 | 188 | 188 | 188 | 65.0 | 89.4 | 104 | 129 |

| Earnings cover (x) | 0.31 | 0.96 | 1.49 | 1.04 | -4.28 | 2.88 | 5.50 | 2.20 |

| Cash ($m) | 18,781 | 20,192 | 26,484 | 17,624 | 31,830 | 36,857 | 40,090 | 38,314 |

| Net debt ($m) | 73,695 | 65,473 | 50,340 | 78,800 | 76,184.0 | 52,229 | 43,705 | 43,227 |

| Net asset value ($m) | 186,646 | 194,356 | 198,646 | 186,476 | 155,310 | 171,966 | 190,472 | 186,607 |

| Net asset value/share ($) | 22.9 | 23.4 | 24.3 | 23.7 | 19.9 | 22.4 | 27.2 | 28.6 |

Source: historic company REFS and company accounts.

Similarly, BP has today guided for lower fourth-quarter production amid a mixed narrative - it improved in gas and low-carbon energy but is down in oil production and operations (its value, partly due to oil price-rise lags). Exploration write-offs were lower than Shell, but then Shell is a bigger operation. Neither BP’s consumer side nor products could rescue its operations narrative, and the oil trading result is expected to be weak.

- ii view: BP warns on Q4 production and delays investor day

- Insider: directors lock in 9% dividend yield

Financially, while BP’s net debt is expected to be down from the third quarter, helped by divestments, $1-2 billion of impairments are likely across the group. Moreover, the effective annual tax charge is now guided at 42% instead of 40% and foreign exchange losses are set to raise the “other businesses/corporate” annual charge to $0.6 billion.

You might therefore say that absent this sudden commodity price-spike, BP’s underlying trajectory – even if short term – explains why its shares are priced for a relatively premium yield. Oil and gas prices were relatively firm during the fourth quarter, but the update is a frustrating read. The shares have eased 2.5% to 420p despite an overall flat oil price today.

BP - financial summary

year end 31 Dec

reporting in US$

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover ($ million) | 183,008 | 240,208 | 298,756 | 278,397 | 161,291 | 157,739 | 241,392 | 210,130 |

| Operating margin (%) | -1.6 | 2.6 | 5.0 | 2.8 | -13.6 | 8.6 | 6.0 | 11.8 |

| Operating profit ($m) | -2,928 | 6,310 | 14,852 | 7,680 | -22,000 | 13,502 | 14,406 | 24,615 |

| Net profit ($m) | 115 | 3,389 | 9,383 | 4,026 | -20,305 | 7,565 | -2,487 | 15,239 |

| Reported EPS (cents) | 0.6 | 21.4 | 46.1 | 19.7 | -100 | 37.3 | -3.4 | 87 |

| Normalised EPS (cents) | 45.3 | 44.9 | 62.2 | 69.1 | -1.5 | 31.9 | 130 | 133 |

| Op. Cash flow/share (cents) | 56.7 | 95.5 | 114 | 126 | 60.1 | 117 | 216 | 181 |

| Capex/share (cents) | 88.6 | 83.6 | 83.1 | 75.6 | 60.8 | 53.7 | 63.6 | 80.5 |

| Free Cash flow/share (cents) | -31.9 | 12.0 | 30.7 | 50.7 | -0.7 | 62.8 | 152 | 100 |

| Dividend/share (cents) | 37.7 | 40.0 | 39.7 | 41.3 | 31.5 | 21.4 | 24.2 | 28.6 |

| Earnings cover (x) | 0.0 | 0.5 | 1.2 | 0.5 | -3.2 | 1.7 | -0.1 | 3.1 |

| Cash ($m) | 23,528 | 24,223 | 21,340 | 20,965 | 29,527 | 26,221 | 23,907 | 28,591 |

| Net debt ($m) | 34,772 | 39,007 | 44,459 | 56,481 | 52,399 | 43,566 | 31,586 | 34,484 |

| Net asset value ($m) | 95,286 | 98,491 | 99,444 | 98,412 | 71,250 | 75,463 | 67,553 | 70,283 |

| Net asset value/share ($) | 49.0 | 49.7 | 49.5 | 48.6 | 35.2 | 38.4 | 37.6 | 41.8 |

Source: historic company REFS and company accounts.

Re-prioritising oil & gas output over renewables

A somewhat perplexing shift in the narratives of big oil companies is the reality check, how adoption of green energy is proving more time-consuming than governments anticipated.

After managers rushed to proclaim a shift towards green energy, 2024 saw a rowing back. Last March, Shell diluted its energy transition strategy, saying investment will be needed to meet demand for fossil fuels. Production of liquefied natural gas (LNG) – seen as critical for energy transition - will grow up to 30% by 2030.

BP’s transition plans have likewise become complicated. Originally, it aimed to cut oil & gas production by 40% by 2030 while expanding renewables but has reduced this target. For example, its number of low-carbon hydrogen projects is down from 30 to 10 and investment in offshore wind and biofuel projects is paused. New oil and gas projects now have priority.

It therefore makes the shares more geared to changes in fossil-fuel commodity prices which are a function of geopolitics, so in this respect I would say energy companies have delayed possible de-risking. Certainly, however, they are in tune with the next Trump administration even if not Ed Miliband.

Crux looks to be global economy later in 2025

I take an Occam’s razor to this complex set of variables affecting BP and Shell, to suggest what really matters for total shareholder return is energy demand linked to strength of the global economy.

There looks to be a median type, possible “base-case” scenario, where the US economy remains relatively strong amid confidence about Trump, while China gradually recovers; hence a muddling through the first-half year despite Europe disappointing.

Oil prices ought to remain propped to some extent by US sanctions unless Trump changes all this. I think the fears of what he is liable to achieve with tariffs may be overstated.

Hence, we could be looking at a stronger fourth-quarter 2025 demand scenario, which is admittedly speculative, although in the meantime BP and Shell offer attractive yields with good cover. While BP trades at around twice tangible book value versus 1.2x for Shell, intangible exploration values have a role. Shell has also entertained the prospect of re-listing in New York unless London rates its shares better.

I drew attention to Shell at around 1,000p on 17 March 2020 as an early share-buying candidate amid the Covid slump; and in March 2022 re-iterated “buy” around 1,900p, with a “buy” stance also on BP around 350p. Such stances weathered last year’s bear market from springtime.

Even though both shares look likely to remain volatile and care is needed not simply to chase momentum, I retain “buy” ratings for 2025.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.